Registering with Phase Market Forum gives you access to the top trading platforms in the industry. cTrader is among the top trading platforms. As you’ll read below, the cTrader platform supercedes the old legacy MT5 platform.

Phase Market Forum is an award winning fully licensed brokerage specializing in narrow spreads and rapid withdrawals, we cater to traders' needs for a reliable platform. At Phase Market Forum, we empower traders through top-notch education and cutting-edge risk management tools. Our commitment is to provide you with the knowledge and resources needed for informed decision-making, coupled with advanced tools that mitigate potential risks and enhance your trading experience.

Moreover, traders get access to trading education and risk management strategies. Additionally, it offers its clients good liquidity and low latency. Thanks to partnerships with other industry players, it now has access to quotes previously only available to high-net-worth individuals.

Trading with Phase Market Forum allows you to pick the best platform to trade. To do this, you must know why cTrader better suits your trading needs.

cTrader is an elegant and easy-to-use trading platform with extensive trading capabilities such as fast order execution and coding customization. Designed by Spotware to balance basic and sophisticated features, cTrader is user-friendly for new and experienced traders. Traders can place sophisticated order types and better understand their orders. Despite being relatively new to the world of trading platforms, cTrader has already gathered a devoted user base of traders.

cTrader Platform

You can trade forex, stocks, and futures on MetaTrader 5 (MT5), a multi-asset trading platform that MetaQuotes developed. MT5 lets users see charts, stream real-time pricing, and place orders with their broker, just like the majority of other online trading platforms. MT5 provides access to financial markets such as foreign currency, commodities, CFDs, stocks, futures, and indexes. Among its many features are automatic trading, copy trading, and technical and fundamental analysis tools.

What traders like most about MT5 is its trading robot functionality, also called Expert Advisors or EAs. Without the trader's involvement, the robots monitor prices and conduct trading operations by following an underlying algorithm. MT5 offers additional advantages, such as a multi-threaded strategy tester, account-to-account fund transfers, and an alert system to inform traders about recent market developments. The integrated MQL5 community chat allows traders to interact with one another and exchange trading advice and ideas.

MT5 Platform

Both platforms are impressive, but we must distinguish between them. Here are some of the differences that exist between the platforms.

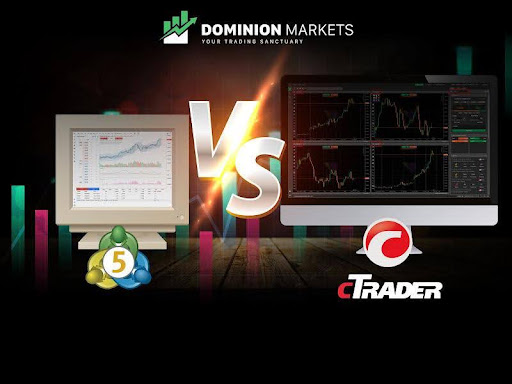

A chart is one of the most crucial components of any trading software, which allows traders to perform technical analysis and display previous data on price movements. This is why the MetaTrader and cTrader applications set aside a significant portion of their interface for this capability.

There are four charts in MT5 by default, each for a different asset. However, traders have the option to maximize just one chart. Regarding chart types, the system supports line, bar, and candlestick charts. Switching between different chart types is straightforward: traders can use the chart menu in the screen's upper-right corner or right-click on the chart and select their favorite kind.

The distinction between MetaTrader 4 ( an older version) and 5 becomes more noticeable regarding the timeframes. There are nine timeframes in MT4: four-minute, two-hour, daily, weekly, and monthly frames. Meanwhile, MT5 provides an additional 12 timeframes for 21: daily, weekly, monthly, hourly, and minute frames.

cTrader and MT5 chart types

Next, there's the cTrader, which displays a single chart in the center of the screen. In contrast to its competitors, cTrader offers the dots chart, area chart and HLC chart in addition to the three earlier chart types. At the same time, a simple right-click on the mouse can change the chart types. This is far better than the chart-switching mechanism in the MT5 platform. There are 26 different timeframes with cTrader: weekly, monthly, three-day, seven-hour, and fourteen-minute frames. Regarding chart types and timeframes, the cTrader platform is the better.

Regarding ease of use, new traders will find cTrader more convenient than MT5. Traders can quickly determine trade sizes and place different trading orders on cTrader.

The design of the two trading platforms, while they could have some modest similarities, is highly different. MetaTrader 5 has an old-school design pattern like that of Windows 98. This platform's design is similar to that of MT4, and its navigation is identical. This makes feeling at home much easier for traders who wish to switch from MT4 to MT5.

Despite its outdated appearance, it serves a very valuable purpose. Navigating the trade site and locating anything you want is incredibly simple. This covers a variety of topics, such as chart settings and indicators.

However, others dislike this design style and want something more contemporary and fresh-looking. This is exactly what cTrader has to offer. Many traders worldwide use the cTrader trading platform because of its simple and up-to-date interface, particularly when compared to MT5. Users of the trading platform can alter every aspect of the interface, including the bright and dark themes.

The cTrader platform still provides traders with a wide range of tools and indicators despite having a much cleaner appearance. This is a major benefit of the trading platform because it balances utility and design.

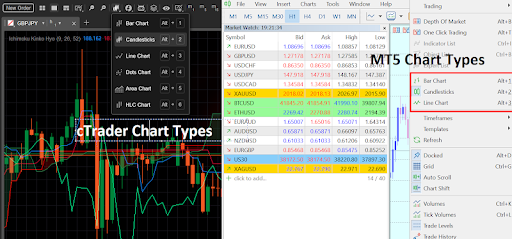

cTrader list of assets

When comparing the trading instruments offered by MetaTrader 5 and cTrader, it is important to note that MT5 was designed to trade a variety of asset classes. On the other hand, cTrader is primarily focused on currency trading. However, depending on brokers, cTrader can be used to trade stocks, indices, commodities and cryptocurrencies as well.

When Metaquotes first developed MT4, Forex trading was its exclusive purpose. And the platform is still quite focused on trading Forex pairs. Although fewer instruments are available than with MT5 and cTrader, traders may still easily download their preferred trading robot or indicator from the MetaTrader marketplace.

Although the restriction still exists, MT5 supports more instruments than its predecessor. This means traders can access even more commodities, equities, and futures. Traders can choose new instruments in the Market Watch window located on the left side of the screen in both MetaTrader 4 and MetaTrader 5. In MT5, there is a separate Plus button for the blank space, but in MT4, one must double-click the mouse.

When comparing cTrader to MT5, the former offers a simpler way to choose new instruments: a Trade window with a Watch list and All Symbols sub-menus on the screen's left side. Traders can view the Popular Markets category and ten distinct asset categories under the All Symbols Sub-menu, such as Metals, Energies, Forex, and more.

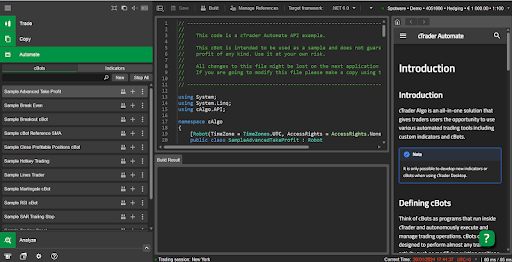

cBot auto trading

Automated trading is the next significant element when comparing the MT5 and cTrader platforms. Expert Advisors are manually programmed algorithms that traders use in MetaTrader apps (MT4 and MT5) to perform automated duties such as technical analysis of price data. Moreover, these algorithms open and close positions on specific instruments.

The primary difference between MT4 and MT5's Expert Advisors is the programming language each uses. Since MQL4 has been around longer than MQL5, traders who lack programming experience can create custom expert advisors using more pre-written scripts and codes. But because MQL5 is a more straightforward programming language, writing new scripts is also simpler.

cTrader also offers similar programs resembling expert advisors, referred to as cBots. cTrader is built on the popular C# programming language. This means that, theoretically, of the three coding languages (MQL4, MQL5, and C#), it is the most widely used and has the largest user base.

In reality, though, cBots are less common than Expert Advisors (EAs), and here's why: EAs have a larger online trading community than cBots do, which translates into more pre-existing MT4/MT5 templates than cTrader. However, it is way too easier to code in cBot as the platform provides you a preset of several code.

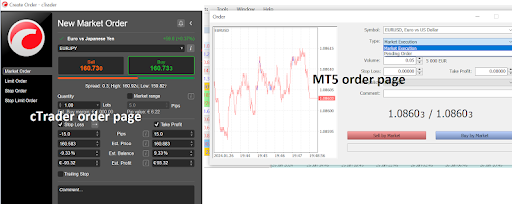

Traders have more control over their positions when using many order types. Both cTrader and MT5 have a lot to offer in this area. Regarding the order kinds available to traders, there are very slight differences.

The primary distinction between cTrader and MT5 is that the former's users can use pending orders even while the market is closed, while the latter does not have this feature. It's also important to remember that cTrader offers far simpler order configuration options when comparing MT5 and cTrader order types.

cTrader vs MT5 order page

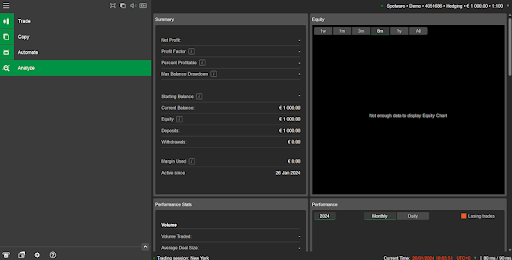

cTrade portfolio analysis

Additionally, cTrader offers order tickets that can estimate potential trade risks. For traders, this can be highly beneficial. Regarding the order types themselves, they are nearly identical on cTrader and MT5. For this reason, many traders consider cTrader to be one of the best alternatives to MT5.

As a trader, you must be eager about performance. cTrader makes it easier for you to analyze your performance in one click. Just click on “Analyze” in the left menu and you’ll see several statistics related to your account. You can easily grasp your weak areas and work our to improve. On the other hand, MT5 accounts report is not much detailed.

With a wonderful interface, you can enjoy some more benefits of the platform. For example:

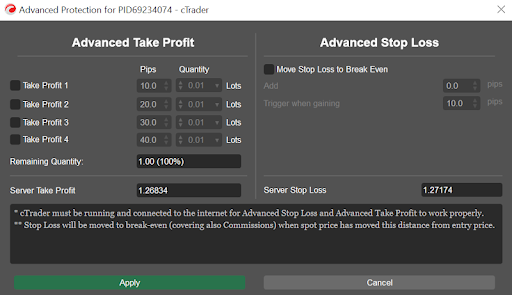

One of the greatest advantages of cTrader is to benefit from the Advanced Stop-loss feature. You can set a target like 10 pips. If your positon moves 10 pips in profit, your stop-loss will be automatically moved to breakeven.

Similarly, you can close your position in profit in multiple chunks using TP1, TP2, up to TP4. It means you can set four profit targets. This feature can help you maximize the profitability while reducing your risk.

cTrader advanced tp and sl window

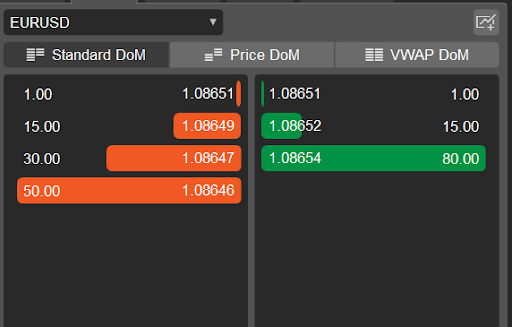

CTrader’s DOM

With Depth of Market, you can see where the majority of traders are heading. At certain price point, you see a big selling or buying volume. You can use this in your advantage on cTrader.

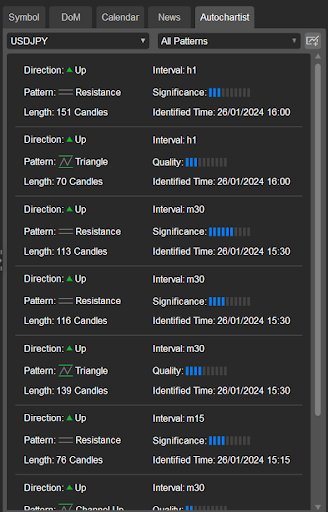

With cTrader, you get free access to the Autochartist. In matter of a click, you find several signals for an asset. The signals tells you the direction, quality and timeframe.

cTrader’s Autochartis

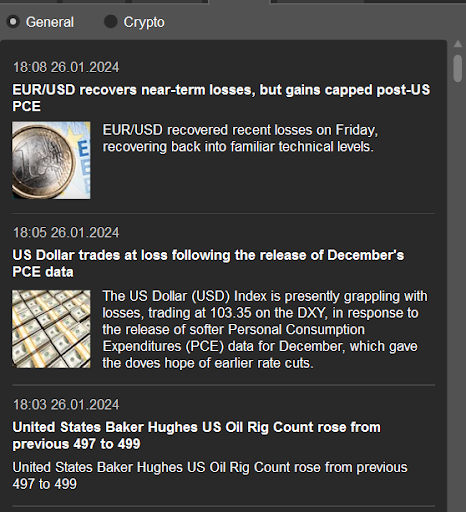

cTrader’s news window

As a fundamental trader, you must be curious what’s driving the markets. Usually the risk sentiment is driven by the news. cTrader keeps you update witht the recent news headlines.

You don’t have to surf ForexFactory or any other website to find the economic calendar. With a single click, you get access to the economic calendar. For your ease, you only see the key events related to the asset on your chart. Like, if you are on EURUSD chart, you’ll find all the events for EURUSD in the economic calendar. You can also switch to another asset or choose another date.

cTrader’s economic calendar

cTrader stands out for its intuitive user interface, advanced charting tools, and transparent pricing, offering traders a seamless trading experience.

cTrader's one-click trading feature, comprehensive charting capabilities, and transparent market depth provide traders with unparalleled control and insight into their trades.

Yes. It is quite user friendly. Most of the functions are self-explanatory. You can easily switch to cTrader. Just create an account on Phase Market Forum and make a deposit.

With cTrader's lightning-fast order execution and customizable interface, traders can execute trades swiftly and tailor their trading environment to suit their preferences, thus maximizing efficiency.

cTrader offers an extensive range of technical indicators and drawing tools, empowering traders to conduct thorough technical analysis and make informed trading decisions.

You can get access to live news feed and economic calendar. It helps you stay update with the current events and data. Hence, it is an edge for your fundamental analysis.

Yes, cTrader at Phase Market Forum offers access to a wealth of trading resources, including educational materials, market insights, and expert analysis, enabling traders to stay informed and enhance their trading skills.

Phase Market Forum is dedicated to providing exceptional support to traders using cTrader. Our team offers responsive customer service, and ongoing platform updates to ensure traders have the tools and knowledge they need to succeed.

Absolutely. cTrader's user-friendly interface makes it accessible to beginners, while its advanced features cater to the needs of experienced traders, making it a versatile platform for traders of all levels.

Yes, cTrader is available on various devices including desktop computers, smartphones, and tablets, allowing traders to access the platform anytime, anywhere, ensuring flexibility and convenience in trading.

You can use “Analyze” function to see different stats like max drawdown, profitability, consecutive profit and losses.

Phase Market Forum offers the trending cTrader platforms. This platform ha many advantages over MT5. When comparing the platforms, you should consider the chart types and timeframes, the design and user interface, and the available trading instruments. Moreover, you should look at automatic and available order types. The cTrader platform is a better choice than the MT5 platform.

Join the Phase Market Forum today and explore the benefits of the cTrader platform.