Common Emotional Challenges

Ah, emotions! They get the better of us every time. And when we talk about forex trading, they sweep our brains like a flood.

However, do you know what common emotional challenges are there in forex?

In this guide, we’ll talk about common emotions that get in the way of a trader and how you can counter them.

A. Fear in Forex Trading

Have you ever encountered a situation where you see the price moving against you, and in sheer panic, you closed the trade? This is what we call the fear of losing. There are different types of fears in forex. Let’s explain them:

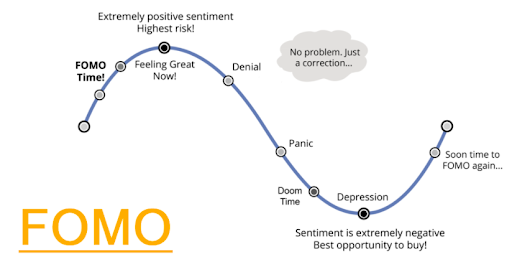

Fear of Missing out (FOMO)

It is perhaps the biggest fear of a forex trader. As the forex market operates round the clock, many traders especially beginners want to grab every opportunity they can.

They’ll take multiple trades during the day and if they lose they’ll do revenge trading. This is the path that leads many traders to a disaster. No wonder 80% of new traders quit within the first two years.

FOMO trading

Fear of Loss

Let’s face it: we are all in the trading game for money, and losing bucks punches you. Fear of a loss makes traders less confident, and they don’t do trading at all.

Fear of Failure

There’s another type of fear that grapples traders; it’s the fear of failure. Everyone wants to win, and if something goes against them, people panic and overtrade.

These are all natural responses, and many traders fell into this trap. But how can you overcome these emotions?

Overcoming trading fears

The first thing is to accept fear is part of the game. It’s a natural response. We just need to control it. After that, you can apply these steps to overcome fear:

Develop a plan

The best way to overcome fear is to develop a rule-based plan and stick by it no matter what. The trading plan ensures proper risk management. You’ll only risk a small portion of your account rather than taking trades blindly.

You tell, which one is worse?

- You losing $10 on a single trade.

- You losing $100 on a single trade.

Of course, the answer is A. With proper risk management in place, you only lose $10. If there wasn’t any plan, you would have lost $100 and run out of the room in a sheer panic.

The good thing is developing a solid trading plan can help you counter all types of trading fears.

Do self-analysis

The best way to overcome fears is to go head-on and counter them through self-analysis. Write down all your trading fears and assess what’s the worst-case scenario?

When you write and assess the worst-case scenario alongside a proper trading plan, you won’t make emotional trading decisions.

Remember: Trading is 90% mindset and 10% skill.

Educate yourself

Learn, learn, and learn. This should be pasted on your trading desk. The beauty of educating yourself is you feel more confident in your trading. And if you are confident in your trading strategies, the fear of losing out won’t disturb you.

To educate, you can read books or visit our blog, where we publish content for all types of forex traders.

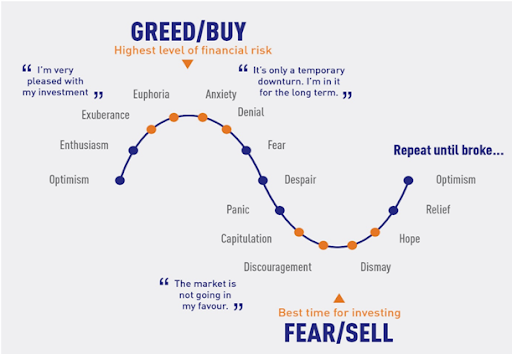

B. Greed and Risk-Taking

Greed and risk-taking are two sides of the same coin in forex trading. Greed often leads traders to take excessive risks, and in return, they lose significant money.

What drives greed in forex trading?

In simple words, greed is the desire for more profits. Traders often become overconfident in their trading and think the market will continue moving in their direction.

One of the biggest factors of greed is the fear of missing out (FOMO). It’s a common human psychology, if we see lucrative opportunities, we’ll keep banging on the same door.

In this way, traders take excessive risks keep holding on to positions and don’t stick to their trading plan or follow risk management.

The cycle of fear and greed

How to overcome greed in forex trading?

So, how can you counter greed and risk-taking in forex trading?

Stick to your plan

Like we said in the fear section, you need to develop a solid plan to curb any emotional biases. By sticking to your plan, you won’t take excessive risks.

For instance, in your plan, if you define the risk/reward ratio per trade to 1:2, then you won’t become greedy whenever the price moves in your favor.

Set realistic expectations

If you think you can win big overnight, it’s not realistic. You need to analyze your trading expectations. Understand that losing is part of the process, and you can’t win every trade or have unrealistic gains.

You need to focus on developing a trading strategy that is consistent and has more winners than losers.

Be patient

It’s important to practice patience in forex trading. You don’t need to become greedy on one trade, rather, you need to look for consistent profits over the long term.

Rome wasn’t built in a day, you know!

Reflect and learn

At the end of each week or month, take the time to analyze your trades. Look out for any signs of greed or excessive risks and whether you trade according to the trading plan.

In this way, you’ll be able to identify the culprit (greed) and will be able to trade according to the plan next time.

C. Impatience and Long-Term Strategies

We talked about patience in the greed section, but we want to hone in on it more here, as it’s a common emotional challenge traders face, especially for long-term trading strategies.

As the forex market operates round the clock, traders want to see instant results, and in this excitement, they take reckless trades. They focus on short-term gains rather than long-term consistency

Although we are talking about forex, we’d like to quote Warren Buffet here:

“The stock market is a device to transfer money from the impatient to the patient.”

What drives impatience?

Here are a few factors that contribute to impatient trading:

Fear and greed

These two emotional biases are the biggest reason for impatient trading. Fear causes you to take on trades you feel you are missing out on. And greed causes you to jump in on every trade on expectations that the market will move in your favor.

Market noise

There’s a constant bombardment of information out there. Everywhere you look, there’s news, market updates, and analysis.

Don’t get us wrong, it’s good to have market updates, but when you constantly consume the news, it makes you impulsive, and you want to take trades. It can be very addictive, and you lose focus on long-term goals.

How to overcome impatience?

Overcoming impatience is easy when you are keeping a long-term perspective. Here are some of the steps you can take:

Be consistent

Rather than chasing after short-term success, try out strategies that give you long-term and consistent returns.

So, how can you do that?

It comes down to sticking to your trading plan, properly managing risks, and resisting the temptations to make decisions based on emotional motivations.

Keep a long-term perspective

It’s important to remember that trading is not a sprint, it’s a marathon; you need to look at the bigger picture. Don’t pay attention to what every YouTube or TikTok guru says, just keep focus on your long-term trading goals.

Develop a long-term strategy and keep testing it constantly till gives you good results. If you are unsure, you can check out some of the forex strategies here.

Final thoughts

Emotions play an important part in trading; however, what separates pros from the herd is how they manage them. Identify the common emotional challenges in trading and overcome them through the steps we mentioned above.

And if you have a fear of “brokers”, you can join Phase Market Forum. We have over 200 tradeable assets spread across various categories and zero trading commissions.