Eight Common Trading Mistakes and How to Avoid Them

Do you know that 80% of day traders quit within the first two months? That’s a shocking statistic and part of some common trading mistakes.

But what are the mistakes that lead to a shocking figure like this, and can something be done?

In this guide, we’ll break down 8 common trading mistakes and how to avoid them.

Make sure to stick to the end, as avoiding these can get you out of the sandbox.

1. Trading with emotions

The first on our list is trading with emotions, which is deservedly so. When beginner traders enter the market, they go through a rush of emotions like greed and fear. They are the two most prominent emotions that play with our heads. Greed occurs when you don’t know when to stop. You want to remain glued to the screen and trade as much as possible. However, the results are catastrophic; you lose more than you should have.

The two biggest fears in trading are fear of missing out (FOMO) and loss. FOMO appears when you think you will miss out on that significant move. Fear of a loss occurs when you don’t want to risk and avoid trading or panic sell because of a loss.

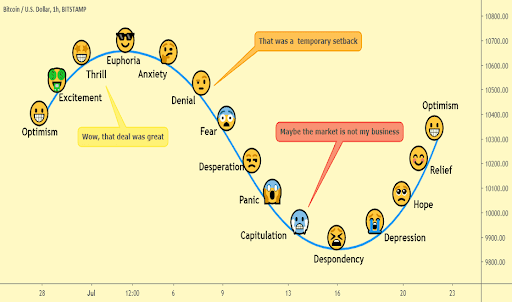

Stages of emotional trading

How to avoid it?

Trading is 90% psychology and 10% trading. Yes, that’s an interesting stat, but that’s what you must remember. As beginners or pros, we get carried away when the market flashes green and red.

However, it’s crucial to stay disciplined and don’t trade emotionally, rather strategically. If you incur a loss, take the L and come back later.

You aren’t going to win every trade. Don’t revenge trade just because you want to get the money back. Stay focused and disciplined and learn along the way to counter emotional trading with logical reasoning.

It’s good that the Phase Market Forum allows real trading account with a nominal deposit like $100.

2. Not having a trading plan

Trading without a plan is like going into a battle without protection. A trading plan defines a clear set of instructions to trade. For instance, your trading plan mentions the risk/reward ratio, strategy, timeframe, session you want to trade in, and such.

Many beginners don’t start with a trading plan, or they don’t even know about a trading plan. They let their emotions work (see how emotions are connected to this) and trade without a solid plan.

How to avoid it?

Plan your trades and trade your plan. This should be pasted on your trading desk. Your trading plan should mention all the rules you need to follow, and you just stick with these rules. Failure to break these rules will result in losses, so keeping that in mind is essential.

3. No risk management

Risks are part of trading, but how you manage them is the real deal. Many traders don’t have a clue about risk management strategies. They use high leverage, start on the live account, and don’t use stop-loss or take-profit orders.

For instance, you take a long position without a stop-loss and take-profit in place. If the price continues against you, your whole account can get wiped out.

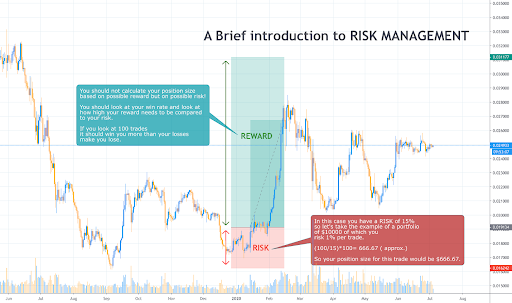

Risk management explained

How to avoid it?

Making some risk management rules in your trading plan is essential. These include:

- You have to place stop-loss and take-profit on every position.

- You will only risk up to 1% of your account balance on a single trade.

- Don’t use a high leverage.

4. Letting losers run

How often have you experienced the trade going against you, but you keep running it as you think the market will bounce back?

However, the market doesn’t bounce back, and you lose more than you should have. Many traders become paralyzed when they see their losing trades. They either wait or panic sell. Either way, it turns out to be disastrous for them.

How to avoid it?

It hurts to see the reds on your trading platform; however, isn’t it better to take a slight loss and not a big one?

Also, you won't lose more if you have a proper stop-loss.

5. Not identifying your trading style

Many traders like the idea of scalping and begin trading. However, they don’t understand that scalping is not for everyone.

Indeed, fast-paced day trading can be beneficial, but for that, you need to properly understand the market trends, which many beginners don’t have.

How to avoid it?

You must identify your trading style at the start of your trading career. If you like the fast-paced nature of scalping or day trading, you have to devise the proper plan and then act on it.

6. Trading multiple markets

When starting, many traders tend to jump from market to market for more profits. They go from forex to stocks to commodities to crypto. However, they don’t realise it can be a huge distraction, and you can lose more.

How to avoid it?

It’s vital to grasp one financial market and learn about the other. In this way, you’ll become more experienced in one field and can avoid trading pitfalls like emotional trading.

7. Starting on a live account

Does starting on a live account with your hard-earned money as a beginner make sense? No, it isn’t!

Many beginners start with a live account, trade for a while, and may even get lucky and wipe their accounts. It’s an error cycle that every beginner goes through when starting on a live account.

How to avoid it?

Before you begin, learning about the market is essential; the best place is the demo account. This account gives you a natural feel, and you can learn without losing money.

Phase Market Forum demo account

8. Not learning

As the great late Charlie Munger said, “If you don’t keep on learning, other people will pass you by.” This quote precisely separates amateur traders from pro traders.

Many traders are too reluctant to learn anything, so they make mistakes. They think a new strategy, learning about the market trends, or researching is boring, and they are in for a get-rich-quick scheme.

How to avoid it?

Trading is about constant learning; you must keep doing it to stay ahead of the competition. You can read books, watch videos, or read helpful content.

Phase Market Forum offers a dedicated education section that enlists trading strategies, platforms, and relevant topics, which can be helpful, especially if you are a beginner.

Final thoughts

Trading can be a daunting task, especially when you are a beginner. However, following simple steps can avoid common mistakes and have more winners than losers.

Choosing a broker is essential when avoiding all the common mistakes we mentioned. Why? If you are trading with a reputable broker, you can get in on your trades with proper risk management, learn along the way, andn’t get high trading fees.

Fortunately, Phase Market Forum provides all these features so you can stay ahead of the curve.