SCALPING STRATEGIES ON cTRADER AND MT5: A COMPARATIVE ANALYSIS

Scalping is a trading approach focused on profiting from minor fluctuations in a security's price. Scalpers take many trades in a single day, typically ranging from 10 to several hundred. For them, it is easier to capture small price movements than larger ones. Moreover, they use strict exit strategies to reduce possible losses, which in turn leads to the accumulation of many small profits over time.

Scalping involves using relatively large position sizes to target small price gains within a brief holding period, typically intraday. The main objective of scalping is to buy or sell a specific asset at the bid or ask price and quickly sell it for a slight profit, either a few dollars higher or lower.

How long you hold these positions can vary, going from mere seconds to a few minutes and, in some instances, extending to several hours. Importantly, scalpers close their positions before the end of a trading session.

EXPLORING SCALPING STRATEGIES IN cTRADER: TOOLS AND TECHNIQUES

Here are some cTrader scalping tools and cTrader trading techniques on Phase Market Forum.

REVERSE OPEN POSITIONS

One useful scalping tool is the reverse open positions. Sometimes, the trend changes too quickly, and you might have many open positions. In this case, you can click the reverse open positions button, and all your open positions will close. Moreover, the platform will submit new orders in the opposite direction with the same volume. It doesn’t happen simultaneously.

MOVING STOP LOSS & TAKE PROFIT TO BREAK EVEN

When it comes to techniques, you can adjust the stop loss to a point where it covers your trading costs, ensuring that winning trades don’t end in losses. Similarly, for losing trades, you can modify the take profit level to a point that accounts for your expenses, allowing you to exit the trade without incurring any losses.

MANAGE YOUR OPEN POSITIONS FOR INDIVIDUAL SYMBOLS

Additionally, with just one mouse click, you can instantly close a portion or your entire open position when trading on cTrader. This feature is ideal for scalping or situations where you need to quickly close trades without the hassle of opening additional windows or trying to close it through the chart.

It offers a quicker way to close your positions through a partial order, allowing you to select a predetermined percentage of the total volume to close.

UNPACKING MT5 SCALPING STRATEGIES: FEATURES AND EXAMPLES

Scalping on the MT5 platform allows you to use different tools and indicators for your trading strategy. An example of a scalping strategy is using the Moving Average indicator- an MT5 scalping feature for the moving average crossover strategy.

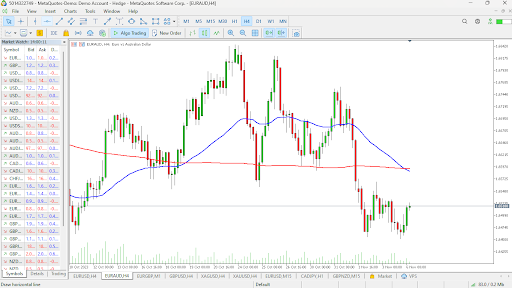

On the one-minute chart, place a short-term and long-term moving average. The entry signals for this strategy are simple. For the buy entry, enter when the short-term Moving Average exceeds the long-term moving average. Place your stop loss two pips away. Your take profit should also be on the same distance. Below is an MT5 trading example:

MT5 Scalping Buy Entry

For the sell entry, enter when the long-term moving average crosses above the short-term Moving Average. Place your stop loss two pips away. Your take profit should also be on the same distance.

MT5 Scalping Sell Entry

A COMPREHENSIVE COMPARATIVE ANALYSIS OF cTRADER AND MT5

When you first start trading, one of the most crucial considerations is which trading platform to use on Phase Market Forum. Your trading platform should be appropriate for your scalping trading needs. Let's look at the two platforms that Phase Market Forum offers. That is the cTrader and the MT5 platform.

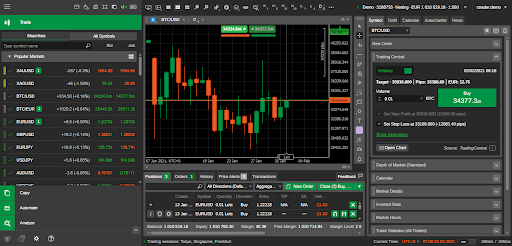

Interfaces: The MT5 platform offers traders many features and indicators that they can customize. Traders use these tools and features to create their trading charts. Moreover, there is a wide range of third-party add-ons in scripts and expert advisors. Meanwhile, the cTrader platform is much more modern-looking in aesthetics and features. Additionally, it offers more intuitive navigation and more order types. Notably, there are very few differences between cTrader and MT5.

Automated trading and backtesting: Most traders love the MT5 platform as it supports automatic trading via Expert Advisors. However, the cTrader package also allows for automated trading and strategy backtesting. Therefore, it is a genuine alternative to MT5.

Availability: The MT5 platform is widely available. Several brokerage firms offer this platform to their traders. MT5 is also available as a mobile app, allowing you to monitor your positions while on the go. Meanwhile, the cTrader platform is less widely available. Still, a growing number of brokers are slowly adopting it.

Charts: Both platforms feature line, bar, and candlestick charts as chart types. Changing chart types is similar: traders can either right-click the actual chart and select the desired kind or go to the chart menu in the top-right corner and do the same.

MT5 Platform

cTrader has three previous and one new chart type - the dots chart. However, as with MT5 software, a right-click on the mouse can quickly change the chart. Regarding timeframes, cTrader provides 26 options, including 14-minute, 7-hour, three-day, weekly, and monthly frames.

Ease of use: When comparing MT5 vs cTrader in terms of ease of use, novice traders will choose cTrader. cTrader makes it simple for traders to calculate trade sizes and use various trading orders.

cTrader Platform

THE CRITICAL ROLE OF EXECUTION SPEED IN SCALPING: cTRADER VS MT5

When scalping on Phase Market Forum, it is crucial to have fast execution speeds on the trading platforms.

Here is why:

Using minor price fluctuations: Scalping strategies revolve around profiting from slight price movements in the market. These price changes are usually fast. By executing trades rapidly, scalpers can quickly enter and exit positions, profiting on these small price movements before disappearing.

Reducing the problem of slippage: Slippage means the difference between the price you expect to get for a trade and the actual price you get. Delays can cause slippage in high-speed markets. For scalpers, slippage can eat into their profits; hence, they try to avoid it by all means. Fast execution reduces slippage, increasing the amount a scalper can earn from a trade.

Effective risk management: Scalping involves making quick entries and exits. Risk management should also be fast to avoid losing a lot of money. The speedy execution helps keep track of the highly volatile market, enabling you to stop losses at the right time to manage risk.

BACKTESTING SCALPING STRATEGIES: HOW TO DO IT ON cTRADER AND MT5

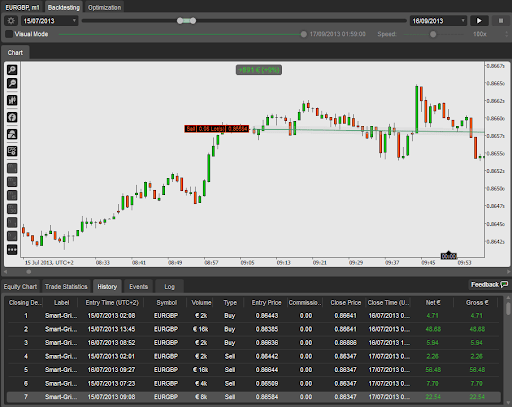

Backtesting scalping techniques on cTrader is evaluating the performance of a scalping approach using previous data. You can use cTrader's built-in backtesting feature or a third-party backtesting program.

To backtest a scalping strategy using cTrader's built-in functionality, you need to create a new cBot project. Code the strategy into the cBot, then attach it to a chart. You should then open the backtesting panel and choose the historical data that you want to backtest. Set the backtest parameters and run it.

cBot backtesting

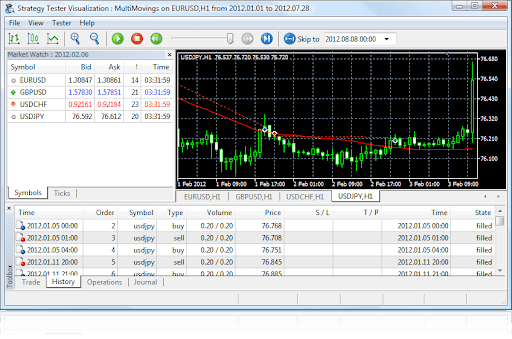

Backtesting scalping strategies on MT5 are different. You should first develop your scalping strategy and then create an expert advisor that can execute it.

You should then configure the strategy tester. Open it on MT5 and choose the expert advisor you want to test. After configuring the strategy tester, run the backtest. You will have access to helpful information, including total profit and maximum drawdown.

MT5 Strategy Tester

ENHANCING USER EXPERIENCE IN TRADING: UI CONSIDERATIONS FOR BOTH PLATFORMS

You can make your scalping strategy work better by customizing the user interface of the platform you choose. With MT5, you can change your charts to show the critical items. You can save these changes to make other charts look the same way—this feature of the MT5 user interface enables easy chart customization. Moreover, you can use multiple tools and indicators in your trading. You can also set shortcuts to place orders quickly. MT5 lets you do this so you can trade faster.

You can customize your cTrader platform by arranging the charts to show the appropriate timeframes and technical indicators. The cTrader user interphase also allows you to set up one-click trading, which is useful when scalping. You can also use the advanced order types that cTrader offers. These include the partial stop loss that you can use for risk management.

MATCHING YOUR SCALPING STYLE TO THE RIGHT PLATFORM: FACTORS TO CONSIDER

Scalping generally requires quick executions. The platform that offers fast market execution is the best for scalping. You should choose the platform that offers modified market orders, such as partial stop loss orders and pending orders.

Depending on your scalping style, you should choose the platform to customize your workspace to include multiple charts and indicators.

MAKING THE INFORMED CHOICE: DECIDING BETWEEN cTRADER AND MT5 FOR SCALPING

Phase Market Forum offers both cTrader and MT5 trading platforms. These platforms each have their advantages and disadvantages. You should study your scalping style and see which platform best suits your needs.

Join Phase Market Forum, the best forex trading company, today and gain access to the top platforms. Test your scalping strategy and trade it on either cTrader or MT5.