Your Trading Strategy for Global Conflicts

Have you ever encountered a situation where the market suddenly dropped, and you wondered why it happened? There’s no significant economic data announcement, and everything seems fine.

But what are the mistakes that lead to a shocking figure like this, and can something be done?

But everything doesn’t seem fine. The market dropped because of a geopolitical conflict. And you got stopped out because you were not prepared.

This guide will present comprehensive trading strategies you can apply when dealing with global conflicts.

How do global conflicts impact your trading?

Before we get started on effective strategies, it’s essential to summarize how global conflicts can impact your trading.

Market volatility increases suddenly whenever a conflict breaks out, sending shockwaves among the multiple economies. Central banks often change their policies because currency value depreciates due to ongoing conflict.

For example, the National Bank of Ukraine intervened in the currency market to support the hryvnia in response to the Russian Invasion.

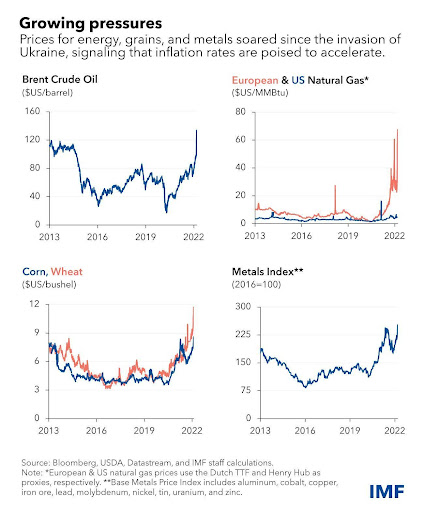

Also, when Russia invaded in 2022, the price of everyday commodities skyrocketed.

Commodities chart amid the ongoing Russian-Ukraine conflict

So, during such disputes, investors tend to move the money out of these economies and fly into safe-haven assets (more on that in a while). As a trader, you need to come prepared, as global conflicts can spur up at any moment.

So, let’s see what strategies you can apply as a trader.

1. Apply a hedge

When a geopolitical conflict happens, you can use a hedge on your current or following positions. A hedging strategy means you are opening a position against your current position. For example, if you open a long position on EUR/CHF, you must also take a short position on the pair.

As we can’t predict the future, a hedge protects you from significant losses if a conflict emerges.

For example, during the trade war between the US and China, the USD/CNY exchange rate accelerated. If you had a short position on the USD/CNY, you would apply a hedging strategy and take a long position. Your losses from the short position would be limited.

USD/CNY chart

2. Trade Safe-haven assets only

If you heard the news about the conflict, trade safe-haven assets only. A safe-haven asset can be defined as one with the tendency to withstand uncertainty.

For example, gold has traditionally been a safe-haven asset. USD, CHF, and JPY are considered safe-haven currencies in the forex market.

By only trading safe-haven assets, you can take short-term positions in such assets and then move to other assets when the conflict eases.

On April 19, 2024, the news broke out that Iran had fired missiles on Israeli soil. There was a market panic, and the flight to safe-haven assets was on as the threat of escalating conflict grappled with the markets.

The chart below shows EUR/CHF losing more than 1% in a single day. In this situation, you would have to continue shorting EUR/CHF. However, there was news of de-escalating tensions over the weekend, so the pair returned to their usual ways.

EUR/CHF chart

You are diversifying in another excellent method to trade safe-haven assets. You have to select these among various markets. For example, selecting EUR/CHF and Gold and only trading these assets till the dust settles.

With the Phase Market Forum, you can trade safe-haven assets across multiple categories. You can trade currencies, commodities/metals, stocks, and cryptos with zero fees. Plus, you can get started with a minimum deposit of $100.

Use currency correlations

You can apply position-sizing to adjust and adapt to global conflicts. Position sizing is all about the size of your trading position. You use it to determine how much you need to put in a trade. This is part of a risk management strategy and helps mitigate risks during conflicts.

Firstly, you need to assess the potential impact of the conflict on asset prices. Next, you can allocate more capital on high-probability trades and take more minor positions in trades with more significant uncertainty.

For instance, when a conflict arises in the Middle East, you can put more capital in oil or USD and CAD and take more minor positions in GBP.

The whole idea of position-sizing is to balance risk and reward during times of uncertainty.

When you open an account with Phase Market Forum, you get access to the cTrader app, which allows you to calculate the size of your positions automatically. So, you don’t have to double-guess about the size of your positions.

Take a scenario-based approach.

Having a trading plan is super important. However, when things are uncertain, a trading plan becomes more important. Whenever any global conflict appears, you can make a scenario to prepare for different outcomes. You can jot down word-case, best-case, and moderate-case scenarios for other assets.

In this way, you’ll have more confidence in your trading strategies and won’t trade with emotions (which escalate with the escalating tensions).

Final thoughts

When a global conflict arises, you have to be flexible and adaptable in your trading approach. These events can lead to sudden market momentum, so you must adjust your trading strategies accordingly.

You can’t predict the future, but you can analyze the present and develop strategies.

It’s important to note that you must keep up with the news. As the development unfolds, you need to monitor what’s happening.

You can check out Dominion Market's blog section to stay updated about all the market stories.